Introduction: In the realm of financial planning, one key aspect that often gets overlooked is securing the financial well-being of loved ones in case of unforeseen circumstances. This is where term insurance comes into play. Term insurance is a type of life insurance policy that provides coverage for a specific period, offering a range of benefits and financial security to…

Personal Finance

Introduction: Retirement is a phase of life that we all aspire to enjoy, a time when we can relax, pursue hobbies, and spend quality time with loved ones. However, to ensure a comfortable and financially stable retirement, it is imperative for individuals to engage in effective retirement planning. Unfortunately, many people overlook the importance of this crucial step, often realizing…

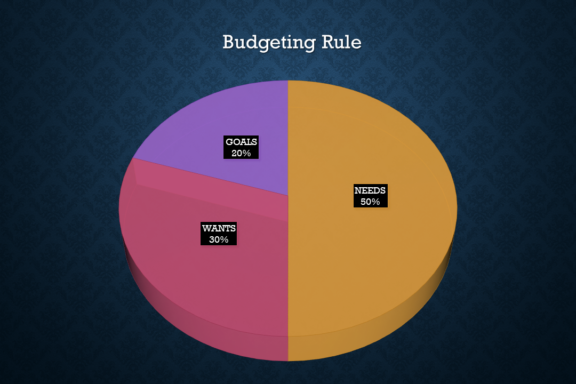

Introduction: When it comes to managing your finances effectively, having a budget is essential. However, creating a budget can sometimes feel overwhelming or restrictive. The 50/30/20 budget rule offers a simple yet effective approach to financial planning that provides flexibility while ensuring you stay on track with your financial goals. In this article, we’ll explore the 50/30/20 budget rule and…

Introduction: Inflation is an economic phenomenon that erodes the purchasing power of money over time. Investors must consider the impact of inflation on their wealth and develop strategies that can protect and preserve their financial assets. In this article, we will explore some effective investment strategies to shield your wealth against inflation, enabling you to maintain and grow your purchasing…

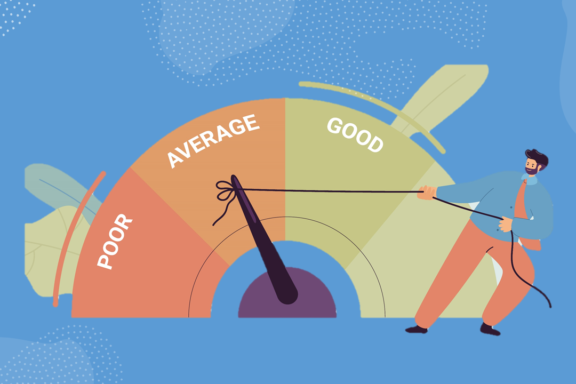

Introduction: Your credit score is a crucial financial metric that impacts your ability to secure loans, credit cards, and other financial products. In India, credit scores are provided by credit bureaus like CIBIL, Experian, Equifax, and CRIF High Mark. A higher credit score indicates creditworthiness and responsible financial behavior, while a low score can limit your access to credit and…

Introduction: Gold has been a valuable asset for centuries, often seen as a safe investment during uncertain times. In India, gold holds immense cultural and economic significance. It is not only considered a symbol of prosperity but also serves as a reliable investment avenue. This article aims to provide a comprehensive guide on how to invest in gold, including various…

Introduction: Systematic Investment Plans (SIPs) have gained popularity as a disciplined and convenient way to invest in mutual funds. One crucial decision for SIP investors is selecting the most suitable date for initiating their investment. Should it be the beginning, end, or middle of the month? While there is no one-size-fits-all answer, this article aims to explore the pros and…

Introduction As individuals approach their golden years, financial stability and security become vital considerations. Senior citizens in India, who are often retired or nearing retirement, need investment avenues that provide regular income, preserve capital, and offer tax benefits. This article aims to provide a comprehensive overview of various investment options available specifically for senior citizens in India. 1. Senior Citizens’…

Introduction: “Rich Dad Poor Dad,” written by Robert Kiyosaki, has become a modern classic in the realm of personal finance and wealth creation. Through the engaging and insightful story of his upbringing, Kiyosaki imparts invaluable lessons on financial literacy and challenges conventional wisdom about money. In this article, we delve into the core teachings of “Rich Dad Poor Dad” and…

Introduction Investing in mutual funds is an excellent way to grow one’s wealth and achieve financial goals. When it comes to choosing between regular funds and direct mutual funds, investors often find themselves faced with a dilemma. While direct mutual funds have gained popularity in recent years due to their lower expense ratios, regular funds still hold several advantages that…